The COVID-19 pandemic has triggered an unprecedented shock to global stock markets, exceeding the economic impacts of prior pandemics. This paper examines the pandemic’s impact on global stock markets across 34 countries, focusing on the relationship between the pandemic’s severity, government policy responses, and economic stimuli. Panel data regressions reveal that increased daily COVID-19 cases initially negatively impacted stock returns and increased volatility. Stringent government measures positively influenced market returns but also heightened volatility. The research challenges previous assumptions about the influence of geographical and economic factors on market reactions. By segregating the sample period by investor sentiment, the study finds a consistent pattern of negative lagged returns, indicating stronger mean reversion during high VIX periods. During low market volatility, government stringency measures are perceived as harmful to economic activity, negatively impacting stock returns. The insights from the COVID-19 pandemic can inform responses to future market disruptions from health crises, geopolitical tensions, environmental disasters, or other systemic shocks.

Avoid common mistakes on your manuscript.

Declared a pandemic by the WHO on March 12, 2020 (Hartman 2020), COVID-19 has significantly influenced global stock markets, leading to sharp declines in stock prices and suddenly increase in volatility (see e.g. Baker et al. 2020; Al-Awadhi et al. 2020; Cinelli et al. 2020, etc.). This effect surpasses any previous infectious disease outbreak, marking COVID-19 as unique in its economic implications. On this day alone, the Dow Jones Industrial Index declined by 13.84%, the Standard and Poorś 500 (S &P 500) fell by 12.77%, and the FTSE MIB plunged by over 18%. In the US volatility levels were found to be even higher than those experienced during the 2007/08 Global Financial Crisis (Baker et al. 2020). Compared to earlier pandemics, the global response to COVID-19, including widespread lockdowns and intense media coverage, has created novel challenges for investors and policymakers. Therefore, as an aftermath, we find taking a further look at the impact of the COVID-19 on global stock behaviour can provide guidance on future pandemics or crisis.

Additionally, the pandemic has garnered unparalleled attention globally, both from governments and the public. Over a hundred countries and territories went into lockdown for at least a month; non-essential air traffic was suspended; and day-to-day travel was reduced to a fraction of that in previous years (Hale et al. 2020). In March 2020, the US imposed restrictions on air travel from Europe, China, and other high-risk areas; the EU implemented widespread travel restrictions, suspending non-essential travel from non-EU countries, which included a coordinated effort among member states to limit air traffic and reduce the risk of importing COVID-19 cases; India suspended all international and domestic commercial flights in March 2020 as part of a nationwide lockdown, which lasted until May 2020, when domestic flights were gradually resumed under strict health and safety guidelines; China significantly reduced international flights in early 2020, maintaining only essential air services to facilitate cargo and the repatriation of citizens. Domestic flights were also reduced, especially in and out of Wuhan, the epicenter of the outbreak. The scope, severity, and duration of government restrictions have been beyond those implemented during any previous infectious disease outbreak. At the same time, information is also spreading faster than ever and with the COVID-19 outbreak constantly making headlines across the media landscape, investors are facing substantial uncertainties (Cinelli et al. 2020).

This paper seeks to bridge a gap in existing literature by analyzing how the COVID-19 pandemic’s severity, government interventions, and their consequent effects shape stock market returns and volatility in various countries. This approach offers a broader perspective compared to previous studies, which have focused more narrowly on either the economic impact of the pandemic or governmental responses individually. This research contributes to a deeper understanding of how these factors interact and influence global equity markets, offering insights that could be valuable for policymakers, investors, and researchers in understanding the economic implications of large-scale health crises.

This research has the following contributions to the literature. Firstly, this paper extends beyond the initial stages of the pandemic, which most prior studies concentrate on. Secondly, it provides a comprehensive analysis throughout 2020, capturing the evolving nature of the pandemic’s impact. Thirdly, built on previous studies focusing on specific regions or markets, this paper investigates stock market responses across 34 countries, offering a more global view. Fourthly, we delve into how the severity of the pandemic and the strictness of government policies influenced market reactions, a dimension less explored in earlier studies. By examining the variations in market reactions based on the level of pandemic severity and policy strictness, this study provides nuanced insights that fill a notable gap in existing research. Finally, our inclusion of controls for seasonal effects and geographical locations to explain stock market changes adds a unique angle to the research. Our findings on the non-significant difference in market reactions between high-income and low-income economies offer a new perspective, as most studies have not explicitly focused on this comparison.

The volume of literature on the financial and economic impact of COVID-19 has also exploded as the number of confirmed cases rises. Research examining the relation between the COVID-19 pandemic and financial markets generally focuses on specific asset classes and geographical locations. The impact on equity markets has been one of the most researched topics (Al-Awadhi et al. 2020; Kowalewski and Śpiewanowski 2020; Just and Echaust 2020; Hartman 2020; Baker et al. 2020; Huo and Qiu 2020; Bai et al. 2020; Ashraf 2020; Sen et al. 2020; Chang et al. 2021; Liu et al. 2022), whilst the unexpected decline in oil prices has also prompted extensive research on commodity markets, including energy and precious metals (Mensi et al. 2020; Gil-Alana and Monge 2020; Narayan 2020; Nicole et al. 2020). The impact of COVID-19 on the debt market has also been investigated (De Sio et al. 2016; Ashton 2009; Aguiar-Conraria et al. 2012). Several studies have highlighted the significant increase in stock market volatility due to COVID-19. For instance, Scherf et al. (2022) using the Generalized Forecast Error Variance Decomposition (GFEVD) method demonstrated that the pandemic led to unprecedented volatility levels across global markets, particularly in higher-income countries which initially overreacted but recovered more quickly compared to lower-income countries. However, as the pandemic progressed, markets demonstrated learning effects, leading to more efficient responses to government interventions and policy measures (Scherf et al. 2022). Similarly, (Andrada-Félix et al. 2024) study noted that the COVID-19 crisis, compounded by the Ukraine war, resulted in more severe adverse effects on the US stock market than previous crises, such as the 2008 Global Financial Crisis. The efficiency of financial markets during the pandemic has been a subject of debate. Initial reactions to COVID-19 were marked by inefficiencies, with significant under- and overreactions. Tiwari et al. (2022) conduct causality analysis and show that there exist a causal relationship exists between the number of cases of COVID 19 infections and stock market liquidity.

Studies that demonstrate the increased volatility present in stock markets and their loss of value as the severity (often measured as confirmed cases and death tolls) of the pandemic increases in the short-term (Gormsen and Koijen 2020; Baker et al. 2020; Just and Echaust 2020; Ramelli and Wagner 2020; Liu et al. 2020; Huo and Qiu 2020; Bai et al. 2020). Similarly, Baker et al. (2020) review movements of the US stock market and find that restrictions on travel and business activities have significantly damaged the US economy. Adopting an alternative focus by analyzing government policies, Zhang et al. (2020) provide evidence that the impact of the pandemic on stock market movements has differed from market to market, but investors generally react positively to government actions that contain outbreaks. The psychological impact of the pandemic on investors has been substantial. Research has shown that negative sentiment and psychological pressure led to increased market volatility (Bai et al. 2023). Media coverage and financial news significantly influenced investor behavior, causing overreactions in stock markets (Ji et al. 2024).

Other than confirmed cases and death tolls from the pandemic, government interventions are also often considered as independent variables in analyses; for example, Rebucci et al. (2022) and Narayan et al. (2021) examine the impacts of governments’ restrictive policies, Zaremba et al. (2020) and Zhang et al. (2020) investigate the reactions of stock markets to control measures such as lockdowns, and school and workplace closures, Toda (2020) investigated the impact of weather. Notably, their results show that the strengthening of restrictions significantly increase stock market volatility. Ji et al. (2024) find that markets initially underreacted to lockdown announcements, followed by overreactions that were corrected over time. Their results indicate that the impact of COVID-19 on stock markets varied significantly across countries. Yu and Xiao (2023) reveal that government responses and societal trust levels played only partial roles in affecting market volatility, whereas Szczygielski et al. (2023) find the opposite.

This study contributes to the literature by offering a comprehensive analysis of stock market reactions across different phases of the pandemic, evaluating the impact of country-specific factors, and exploring the relationship between the severity of the pandemic, government policy strictness, and market responses. By comparing the effects of COVID-19 policies across markets and phases of the pandemic, this study highlight how national contexts, such as healthcare capacity and governmental trust, modulate the impact of these policies. We investigate feedback effects where rising case numbers lead to stricter controlling measures, which may in turn affect equity markets, can provide a more comprehensive picture of the pandemic’s impact.

Our analysis indicates that increases in daily confirmed cases led to decreased returns and increased volatility, as demonstrated by Al-Awadhi et al. (2020), Akhtaruzzaman et al. (2021), Andrada-Félix et al. (2024), Ji et al. (2024), especially in the first quarter of 2020. However, the reaction of stock markets varied depending on the severity of the pandemic and government responses. Notably, our findings challenge some of the early assumptions that the market responses to the pandemic strongly and long lasting Brodeur et al. (2021), Song et al. (2021), providing new insights into the interplay between public health crises and financial markets. We observe that stock market returns fall immediately following increase in daily new confirmed cases in the majority of countries but recover quickly in the second quarter of 2020. To address this issue, we introduce seasonal controls and examine the extent to which they explain the time-series variation of COVID-19 impact.

We then turn to the pandemic’s severity and government policies’ strictness in different countries to address the inconclusive results presented by previous research. Controls for severity and strictness groups are added to the baseline model. This way, we are the first to illustrate how stock markets in countries with different level of severity and strictness react to the changes in daily new confirmed cases and government policies. According to our observation, the equity market reacts more dramatically to increase in daily new confirmed cases in countries with higher severity level. Furthermore, increase in stringency leads to greater volatility especially for countries with low level of strictness.

Next, we evaluate whether markets reacted differently to the COVID-19 pandemic depending on their development status and dependence on domestic income. To test this, we run panel regressions with variables controlling for the income level of economies. We find no evidence of stock markets in high-income economies reacting differently than those in low-income economies.

Toda (2020) argues that the cold weather in the Northern Hemisphere may affect the spread of the virus and in return negatively affect the stock market. However, it should be noted that not only the Northern Hemisphere, the Southern Hemisphere was also affected by the pandemic during summer. Previous research was normally conducted at the early stage of the pandemic when patterns were not fully discovered. To address this issue, we include the whole 2020 as sample period and include controls for geographical locations. We discover that geographical locations cannot explain stock market changes, and the stock market recovered since the second quarter.

Previous research on the impact of the COVID-19 pandemic has concentrated mainly on the pandemic’s early stage and the impact caused by total cases or total death tolls (see e.g. Albulescu 2020; Baker et al. 2020; Baek et al. 2020, etc.). However, changes in equity market returns and volatility based on the level of severity of the pandemic and government policies’ strictness still remain under-researched. As governments enact life-saving policies, this study provides empirical evidence on global stock market reactions to both the COVID-19 pandemic and the ensuing policy responses.

COVID-19 data were sourced from the CSSE at Johns Hopkins University (Dong et al. 2020). To address potential time lags and inaccuracies in this data, we cross-referenced it with government-reported figures, ensuring alignment with stock market data timelines. Reported cases are sometimes subject to inaccuracy; hence, we modify the data in some cases according to government corrections. Claimant countries consider disputed territories differently, which also may cause mismatch between government-reported cases and those in the database.

To gain insights into government responses, we employed the Oxford COVID-19 Government Response Tracker (OxCGRT), focusing on stringency and economic support indices. This included examining the stringency and economic support indices, as well as specific containment measures. In particular, we focus on the stringency index, the economic support index, and procedures that aim to control COVID-19 outbreaks. This last category of policies includes school and workplace closures, prohibition of public events, restrictions on gatherings, public transport cancellations, stay-at-home orders, and national and international travel controls. The incorporation of daily COVID-19 case numbers and detailed government policy data provides a dynamic view of the pandemic’s progression and response measures. This approach allows for a more nuanced understanding of how these factors influence stock market volatility and returns. To investigate the trend shifting in investor sentiment, we collected the VIX index price in the same period and construct high and low VIX periods following (Smith et al. 2016).

Our study assesses the impact of the COVID-19 crisis by analyzing the returns and volatility of major stock market indices. Using data from 34 countries’ stock markets allows for a comprehensive and diverse analysis. This broad scope enables the capturing of a wide range of market reactions to the pandemic, providing a more global perspective. We gathered daily open, high, low, and close prices for stock indices from 34 countries Footnote 1 , Footnote 2 each representing their respective primary market portfolio. To ensure robustness, indices with high internal correlations (as shown in Table 3) were consolidated, resulting in a final sample of 34 indices. Our primary data sources were Yahoo Finance, supplemented and verified through Investing.com, forming the analytical foundation of our study. The statistical properties of these indices, detailed in Tables 1 and 2, indicate varying impacts of the pandemic based on countries’ economic dependencies and government measures. Our results indicate that the average daily return is not solely determined by the number of new daily cases or geographical location. Countries whose governments employ strict rules to control the spread of the virus tend to experience tend to experience decline in their economies.

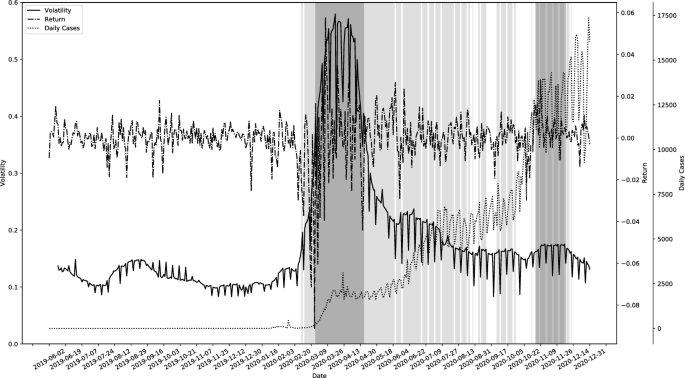

The data from June to December 2019 serves as a baseline, showing the state of the equity markets before the onset of the COVID-19 pandemic. The level of volatility and returns during this period can be considered ’normal’ or ’typical’ market conditions, against which the pandemic’s impact is measured. The steep rise in volatility at the beginning of the pandemic (early 2020) likely reflects the market’s immediate reaction to the uncertainty and economic disruption caused by COVID-19. This increase in volatility is a common response in financial markets to unforeseen, high-impact events, as investors reassess risks and potential impacts on company earnings and economic growth.

The observation that the equity market became less volatile after the first quarter of 2020 suggests a period of market adjustment. This could be attributed to investors gradually digesting the initial shock of the pandemic and adapting to the ’new normal’. This period may also coincide with various government and central bank interventions aimed at stabilizing the markets and the economy. The fact that volatility levels remained higher than the pre-pandemic level throughout 2020, despite a decrease after the first quarter, indicates ongoing market sensitivity and uncertainty. This could be due to continuing concerns about the trajectory of the pandemic, its long-term economic impacts, and the effectiveness of policy responses.

The trend may reflect underlying shifts in investor sentiment and behavior in response to the pandemic. For instance, the initial spike in volatility might indicate panic selling or a rush to liquidity, while the subsequent moderation could suggest a period of cautious optimism or market stabilization.

In our analysis of the statistical properties of equity markets during various periods of the COVID-19 pandemic, we observe a marked shift in market dynamics compared to the pre-pandemic period. Results are presented in Table 4. During low VIX period, the market exhibited a relatively stable pattern with average returns hovering close to zero and moderate volatility. However, with the onset of the pandemic, both returns and volatility underwent significant changes. The increased range and standard deviation pointed to more pronounced fluctuations, reflecting heightened market risk and investor uncertainty. The equity market have shown different landscape under different level of VIX, which reveals the necessity of investigating the impact of the pandemic and government responses to the pandemic in low and high VIX period separately.

In Panel B, the positive coefficients for the lagged first difference of Yang and Zhang volatility ( \(>^2>\) ) across all models indicate that higher volatility on one day tends to be followed by higher volatility the next day, showing a continuation of market uncertainty. Stock markets are found to be more volatile for countries with low severity level. Stock markets in those countries react more drastically to the increase in daily new confirmed cases than countries with higher severity level. The interaction terms between confirmed cases and severity levels show a positive and significant relationship with volatility over the whole 2020, suggesting that higher pandemic severity leads to increased market volatility. However, separating the year according to VIX level, we find that the increase of confirmed cases does not further lift volatility in the market. The government policy stringency and its interaction with strictness levels show mixed results. During low VIX period, stock market volatility increase as rules getting stricter, whereas the changes in rules can hardly affect market volatility during high VIX period.

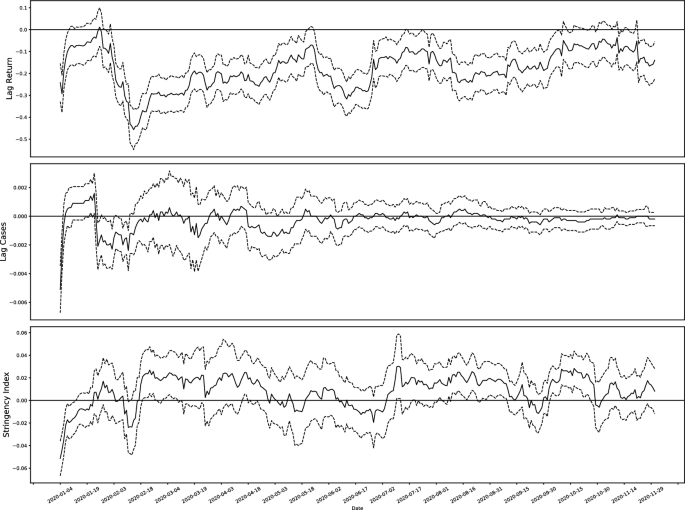

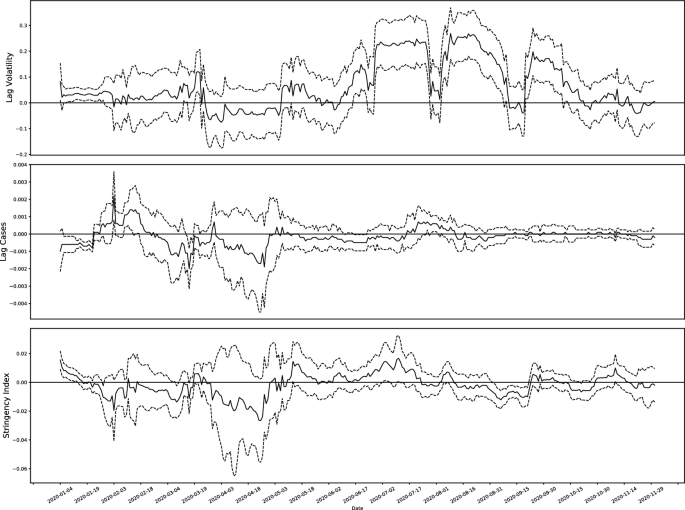

Figures 2 and 3 show the estimated coefficients for daily new confirmed COVID-19 cases and the stringency of government policies, examining their relationship with stock market returns and volatility, respectively. The dashed lines representing the 95% confidence intervals in both figures underscore the statistical significance of these findings. The results show that changes in daily new confirmed cases gradually ceased to influence stock market returns and volatility. Furthermore, stock market returns and volatility tend to rise in case of strict restrictions.

In Fig. 2, the rolling estimates for the impact of new cases on market returns initially show significant variability, indicating a strong market reaction to the pandemic’s early developments. However, over time, these effects appear to diminish, suggesting that markets gradually adapted to the ongoing pandemic, reducing the influence of new case numbers on returns. This observation aligns with the notion that financial markets can absorb and adjust to persistent risks over time. In contrast, stringency index is found to load more on return. which indicates that returns tend to be higher when policies are strict. However, such relation is not statistically significant.

Figure 3 demonstrates a less significant impact of new cases on market volatility. Furthermore, the analysis reveals that stricter government restrictions tend to increase both market volatility. This dual effect of volatility and return can be attributed to the confidence instilled by decisive government action, which may boost returns, alongside the inherent uncertainty associated with such interventions, contributing to increased volatility.

The rolling window analysis highlights the dynamic nature of market responses to the COVID-19 pandemic. The gradual decrease in the influence of new cases on returns suggests market adaptation, while the impact on volatility shows the persistent uncertainty surrounding the pandemic. These findings offer insights into how global financial markets navigate periods of crisis and uncertainty, contributing to a deeper understanding of market behavior in the face of global health emergencies.

To affirm the reliability of our findings, we conducted robustness checks using two alternative methods for calculating stock market volatility: the historical close-to-close volatility and the Garman-Klass volatility model. These methods were chosen for their distinct approaches to volatility estimation, thereby providing a comprehensive validation of our results.

Historical close-to-close volatility: We recalculated the stock market volatility using the historical close-to-close method, defined by the formula: